Porsche’s vision beyond electrification?

Porsche recently shared an official announcement detailing its strategy for the foreseeable future. At first sight, it could look like the company is going back on its electrification plans after a few years of relatively underwhelming performances and heavy depreciation that affected the Taycan so much, it has almost become a symbol for the risks of buying luxury electric vehicles. However, on a second look, it appears there is more to it. But let’s back up a bit and look at the brand’s recent history.

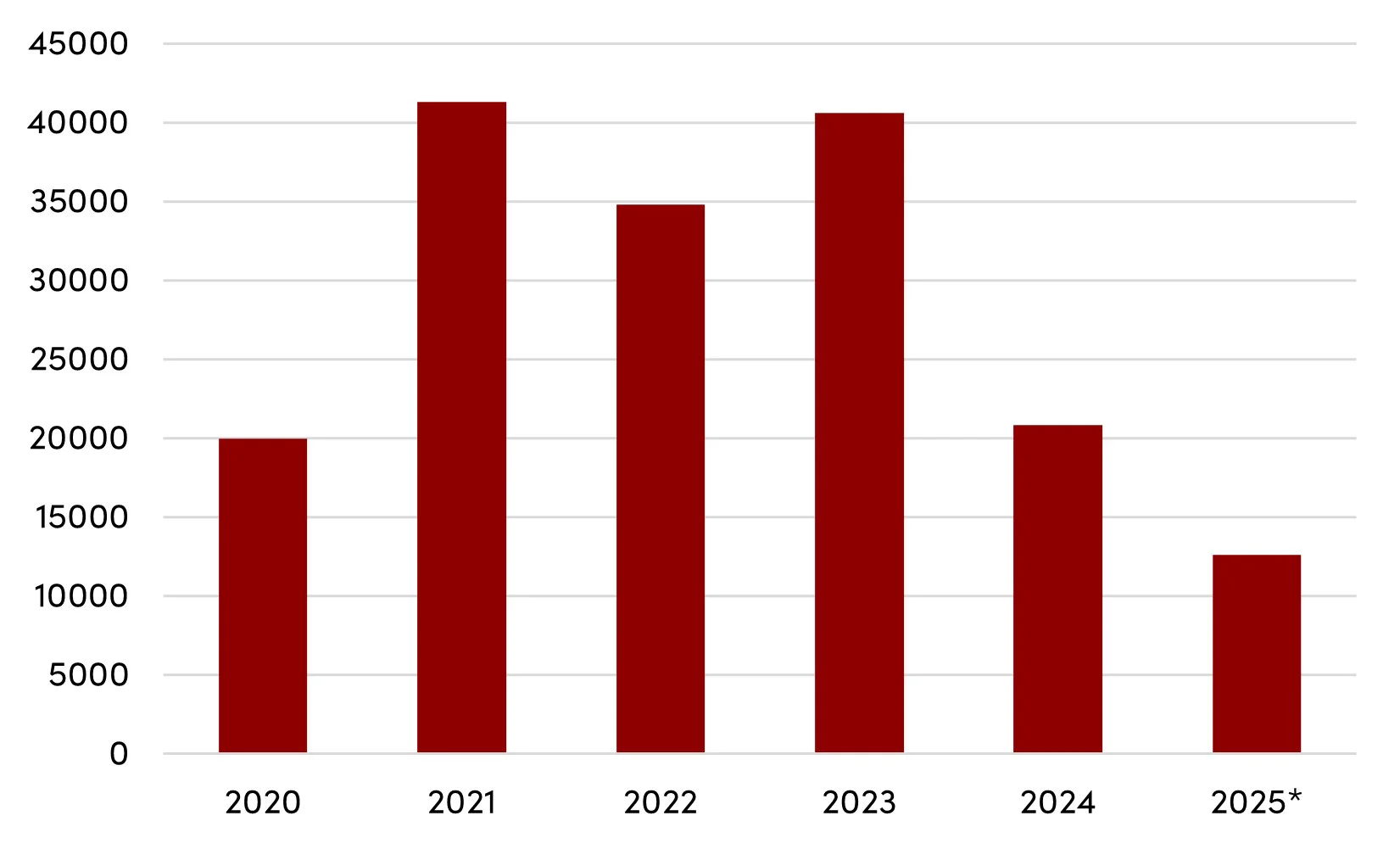

Since launch, after a first period of strong interest by early adopters during which the Taycan sales grew quickly, the performance of full-electric vehicles has not satisfied expectations. After peaking in 2021, sales have stagnated at best through to 2023, and due to low demand and depreciation, they halved in 2024, going back to 2020 levels. In the first 9 months of 2025, Taycan sales fell by another 10% compared to an already poor 2024, but the new full-electric Macan seems to have obtained good results overall with over 36,000 units sold. These not only outpaced the 28,533 ICE ones but resulted in a total of 64,783, increasing by 18% the Macan sold up to Q3 2024.

Porsche's Yearly EV Sales (2021- Q2 2025*)

So, going back to Porsche’s recent announcement, while a substantial scale-back on electrification is definitely a key step in this renewed business and product strategy, the objective is not just steering away from it. But first, let’s see the announcement in detail.

Porsche’s key measures

The first line in the press release states the upcoming product line will be supported by ‘brand-defining’ models featuring combustion engines. These will likely include the 911 ahead of any other, and all its derivates.

Additionally, the new SUV line, which will be positioned above the Cayenne as was initially planned as full-electric, will be offered at least in its early phase only with an internal combustion engine (ICE) or as a plug-in hybrid (PHEV).

The ICE models already present in the lineup will receive a longer life cycle, and in between these and the eventual electrified substitute, more models have been added. Similarly, the new EV-dedicated platform planned to be released in the 2030s will be delayed.

*New Cayenne testing

*New Cayenne testing

Finally, the current full-electric models (Taycan, Taycan Cross Turismo, and Macan) will continue to receive updates and remain a consistent component of the product lineup. Additionally, a new all-electric Cayenne and 718, derived from the Mission-R teased a few years ago, will be added to the lineup as well.

According to the statement, while these measures are organised to secure long-term financial success, Porsche expects them to lead to additional depreciation and potential provisions. The financial expectations for the year are of similar revenues, but lower returns than previously forecasted. Lower automotive EBITDA is expected as well.

What does it mean for Porsche’s strategy?

The potential of electric vehicles is not overlooked, but requires a more cooperative effort by the group. After the many difficulties faced by Volkswagen software developer CARIAD, the Group has turned to American Rivian to create a Joint Venture that will grant them expertise to develop SDV platforms, both hardware and software, for the upcoming generation and new software.

In the words of Porsche’s CEO Oliver Blume, with this strategic shift, the OEM wants “to meet new market realities and changing customer demands”, “These decisions build on the previously announced initiatives and help us to achieve a very balanced portfolio. This increases our flexibility and strengthens our position in a currently highly volatile environment. […] we want to meet the entire range of customer requirements.”

*Porsche CEO Oliver Blume

*Porsche CEO Oliver Blume

The new strategic arrangement allows Porsche to be ready and more responsive to such an uncertain and fast-changing market. Sports cars, GT, and SUV lines will all offer choices between ICE, PHEV, and BEV powertrains to be able to cater to any potential new request. Through innovation and flexibility, companies can reduce risk by diversifying the product portfolio to maintain business stability. On top of that, effective marketing is the key to communicating to clients this diversity, the relative added value, and competitive advantages, building a stronger brand image. In these market conditions, this strategy builds resilience and ensures relevance by also playing on the brand strengths in the face of inevitable change and an increasingly stronger competition.

In time, this could also translate into a deeper diversification by adopting a geography-based approach that is usually not applied (or in a very limited way) by luxury brands such as Porsche. A 2019 research by the Journal of Risk and Financial Management investigates how this type of diversification can positively impact a company’s financial performance both in terms of return on assets and return on equity. From the research, the varying results obtained with different diversification models are explained through inefficient utilization of resources, especially in terms of innovation for a specific market. Additional risk with this approach is identified for both product diversification and geographic diversification based on the Agency Theory, with managers opting for diversification strategies that fit their personal benefits. These instances naturally negatively affect the financial performance, even though not in the totality of cases.

While it would be extremely capital-intensive for a luxury automaker to develop entirely new products for a single market (even though there could be noteworthy considerations to make for large markets such as China), a higher-level strategy seems feasible. One relatively common solution for the Asian markets in the past has been to introduce exclusively for those regions extended-wheelbase models. As the Chinese EV market continues to grow more rapidly than any other, Porsche caters to a more “traditional” audience used to the added value of its ICEs performance stabilising its business globally. At the same time, it can continue to develop its next-gen electrified generation more effectively and with less pressure to address the Chinese market and other more EV-focused ones that might develop in the coming years.

If you like what you read here and you would like to support me in developing this platform you can do it here:

IF YOU WOULD LIKE TO SUPPORT ME AND THIS WEBSITE’s DEVELOPMENT